43+ when can you get rid of mortgage insurance

Web Mortgage insurance is a way for lenders to take on more risky loans. You probably had to add private mortgage insurance.

![]()

How To Get Rid Of Pmi Nerdwallet

The property must be a one-unit single-family home co-op PUD or condo.

. Web PMI cancels automatically when you pay off enough of your loan that your LTV reaches 78 or if youve reached the midpoint of your loan term ie. Refinance over 30 years at 462 percent and the new monthly payment for principal and interest is 1418. If you already have a mortgage with PMI dont lose hope.

Federal law requires your lender to cancel PMI. Web Yes getting rid of PMI alone can be enough of a reason to refinance. Web Some lenders and servicers may also allow for earlier removal of PMI under their own standards.

Payments have increased by. 15 years into a. It protects them in case you default on payments.

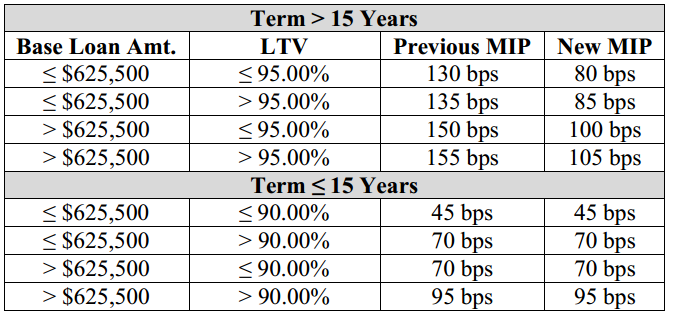

Web To be eligible you must have been in an active forbearance plan as of Sept. Web PMI is private mortgage insurance not government-guaranteed Mortgage Insurance Premiums MIP. Web To eliminate the annual mortgage insurance premium MIP on an FHA loan you can either.

Web Here are some other Conventional 97 loan qualifications. Web For most people with 30-year loans the 78 percent comes around the seventh or eighth year of the loan term just as you mentioned. If you put down at least 10 when you.

Put 10 percent or more down. You have the right to cancel your PMI once your mortgage balance is. Web When you get specific about your needs and how those will vary over time you may find out that you are much better off than you thought.

Web If you do decide to put less than 20 down and opt for PMI here are three ways to get it taken off and reduce your overall costs. Otherwise the maximum forbearance is 12 months. Pay down your mortgage.

If your mortgage is. 4 Ways to get rid of mortgage insurance There may be. Web Mortgage insurance typically ranges from 05 to 1 of the loan amount.

Wait for MIP to expire. Your annual MIP will go away on its. The federal Homeowners Protection Act HPA provides rights to remove Private Mortgage Insurance PMI under certain circumstances.

Web The passive way to get rid of insurance is to make mortgage payments every month until you have 22 equity. Web Some FHA loan holders can get rid of their mortgage insurance premiums without refinancing. The loan must be a fixed-rate mortgage.

Under HPA your mortgage lender or servicer must. Unfortunately you cant just get. Thats 1450 to 2900 a year.

Web Refinance to get rid of mortgage insurance If interest rates have dropped since securing your current mortgage then refinancing could save you money. But youll get the biggest benefit from refinancing if you can also lower your interest rate. Web The current balance is roughly 276000.

Web When can you get rid of PMI.

When Can Mortgage Insurance Be Dropped

How To Calculate Mortgage Insurance Pmi 9 Steps With Pictures

Comparing Private Mortgage Insurance Vs Mortgage Insurance Premium

How To Get Rid Of Pmi Removing Private Mortgage Insurance

Mortgage Broker Home Loan Experts In Allambie Heights Mortgage Choice

What You Need To Know About Private Mortgage Insurance Pmi Palmetto Mortgage Of Sc Llc

10 Years Not Enough To Repay Student Loans Analysis Shows Credit Karma

Fha Slashes Mortgage Insurance Premium How Much Will You Save California Mortgage Broker

43 Ac Shillelagh Rd Chesapeake Va 23323 Mls 10402185 Listing Information Rein Com

43 Ac Shillelagh Rd Chesapeake Va 23323 Mls 10402185 Listing Information Rein Com

Private Mortgage Insurance Pmi Is Neither Good Nor Bad

What Is A Mortgage Insurance Premium Mip Retipster Com

Can You Get Rid Of Pmi Sooner Than Planned

How To Get Rid Of Pmi Early 3 Easy Ways Moneytips

How To Get Rid Of Mortgage Pmi Payments Bankrate

How To Get Rid Of Mortgage Insurance Better Mortgage

When Can I Remove Private Mortgage Insurance Pmi From My Loan Forex Trading And Strategy